Third quarter GDP came in “WEAKER THAN EXPECTED” as economic growth continues to slow in Kamala’s economy

Trump War Room – Third quarter GDP came in “WEAKER THAN EXPECTED” as economic growth continues to slow in Kamala’s economy pic.twitter.com/CrowUhkSKO

— ʇɥǝɯ9ʇɥǝɹqoxx (@M9therB9xx) October 30, 2024

This advance print, coming days before a Presidential election, was going to be suspect. Not including subsidies, govt spending accounting for 30% of this GDP report. With subsidies, it is much higher. The private sector is not strong. Biden and crew are hiding the bad economy with massive hiring all across the board, which only increases our debt more and more. We are headed to economic collapse if Musk and Trump do not slash government starting in January. But, this is the plan all along. The Great Marxist Reset can only be achieved if they topple the U.S. dollar and economy. Biden, Obama and crew are doing all they can to accomplish this.

- The U.S. economy grew at a rate of 2.8% in the third quarter.

- This marks a slight decline from the previous quarter’s 3% growth.

- Consumer spending was a major driver of growth.

- Lower inflation rates encouraged consumer purchases.

- Wage increases also supported spending power.

- Exports contributed positively to the GDP.

- Government spending was another growth factor.

- Federal Reserve rate cuts aim to sustain growth.

- High borrowing costs impact consumer spending cautiously.

- The IMF revised its U.S. growth forecast to 2.8% for 2024.

- Slight slowdown expected for 2025, projected at 2.2%.

- Economic stability remains a Fed priority.

- Inflation control measures continue.

- The labor market remains relatively strong.

- Future GDP growth may moderate as rates stabilize.

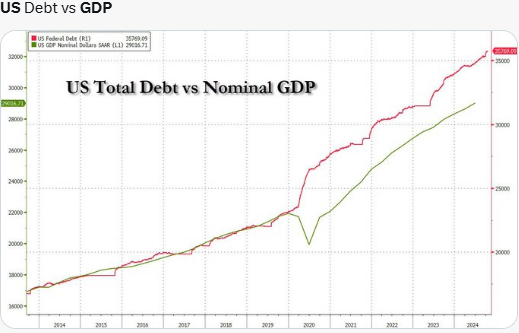

ADP #Employment Change came in hot at 233k versus the consensus forecast of 115k The first estimate of Q3 #GDP came in at 2.8% versus the consensus forecast of 3% Core PCE Prices came in at 2.2% versus the consensus forecast of 2.1% These are excellent data for investors, but I suspect we have already discounted almost all the good news, and I think valuations are stretched, especially at the Mag-7 Level, where their forward P/E is at 32x. Investors should consider overweighting the remaining 493 constituents of the $SPX because they are still expensive by historical standards, at 19x, but still cheaper compared to big tech companies. What concerns me is our deficit. Our debt keeps rising with an economy running above potential, which is a problem because deficits usually widen during a recession. This could lead to a spike in our deficit whenever we hit a soft patch in the economy. I anticipate that the high supply of treasuries will continue to face limited demand, potentially pushing the 10-year interest rate well above 4.5%. The only way the US can manage the deficit is to continue to grow above potential. It is critical to keep the unemployment rate down and consumers spending money. This growth is not just a goal but a necessity in our current economic situation. We can only kick the can down the road because politicians will not cut spending or increase taxes.

Stolen Liberties & Echoes of Freedom. 2nd American Revolution Begins – A short story by CK Sheldon, for Whatfinger News….

Chapter Links

Chapter 1 page 1

Chapter 1 Page 2

Chapter 2

Chapter 3

Chapter 4

Add comment