Listen to a convo on the vid…. much more below the conversation

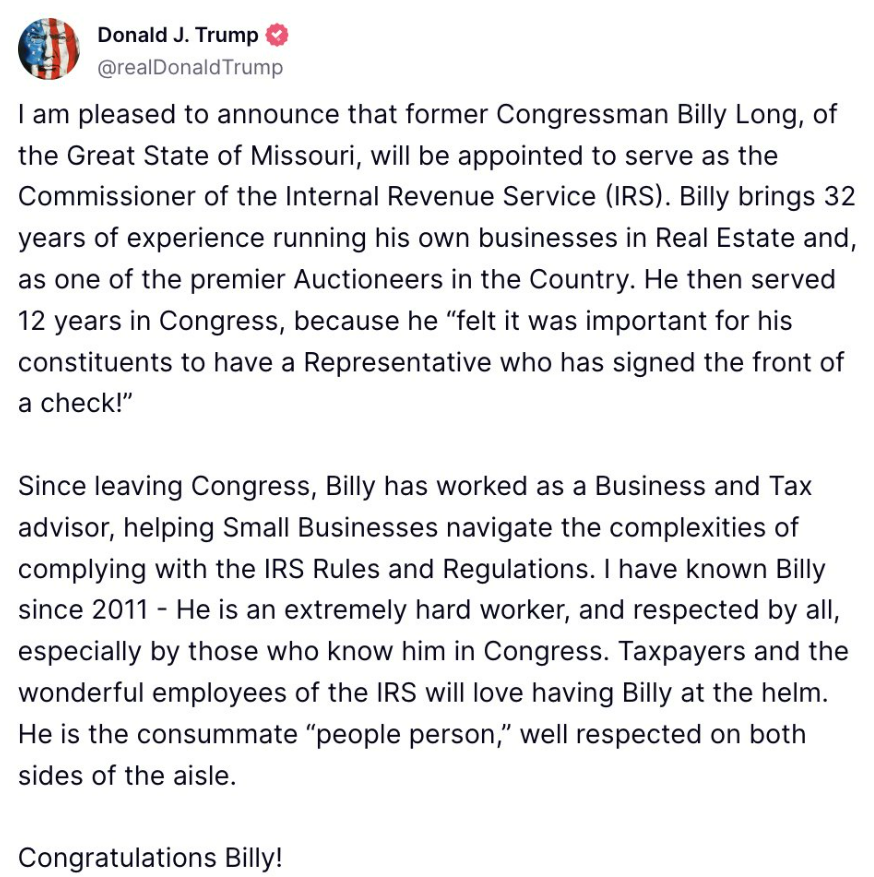

President Trump just dropped a bombshell by nominating Billy Long, a former auctioneer, to be Commissioner of the IRS. Long famously made one of the funniest jokes in Congress about the national debt.

President Trump just dropped a bombshell by nominating Billy Long, a former auctioneer, to be Commissioner of the IRS.

Long famously made one of the funniest jokes in Congress about the national debt. pic.twitter.com/4pX57ZiC6y

— George (@BehizyTweets) December 4, 2024

Donald Trump Is Talking About Plans The Eliminate The Income Tax El Salvador’s President Nayib Bukele Says The IRS & Excessive American Tax System Are COMPLETELY UNNECESSARY “You pay high taxes only to uphold the illusion that you are funding the government, which you are not” “The financial situation of the United States. When I talk to my conservative friends right here, they always tell me that the problem is high taxes, but they’re wrong. Of course, high taxes are extremely high here in the United States. I give you that. You’re right in that. But that’s not the real problem. The real problem is not the high taxes themselves, but the fact that they are not even really funding the government. But even those high taxes, higher than a lot of places in the world, not even those taxes are really funding the government. So who’s financing the government?

Government is financed by Treasury bonds, paper. And who buys the Treasury bonds? Mostly the Fed. And how does the Fed buy them? By printing money. But what backing does the Fed have for that money being printed? The Treasury bonds themselves. So, basically, you finance the government by printing money out of thin air. Someone could ask someone could ask, well, so if the government can print the limited amounts of money out of their error, why did they collect taxes? I mean, in theory, it would make sense. Right? If they can put unlimited amounts of money, why would they need taxes for? The answer is simple, but it’s very shocking. The real problem is that you pay high taxes only to uphold the illusion that you are funding the government, which you are not. It’s shocking, but it’s true.

The government is funded by money printing, paper backed with paper, a bubble that will inevitably inevitably burst. The situation is even worse than it seems because if most Americans and the rest of the world were to become aware of these bars, confidence in your currency would be lost. The dollar will fall and the western civilization with it. If the next president of the United States doesn’t make the necessary policies and the structural changes, sooner or later that bubble will burst. There’s still time. You don’t have to make the same mistakes we did in the sixties seventies. You can still jump before the water boils.”

Donald Trump Is Talking About Plans The Eliminate The Income Tax

El Salvador’s President Nayib Bukele Says The IRS & Excessive American Tax System Are COMPLETELY UNNECESSARY

“You pay high taxes only to uphold the illusion that you are funding the government, which you are not”… pic.twitter.com/xnktMuDTwF

— Wall Street Apes (@WallStreetApes) June 28, 2024

Briefing Doc: Donald Trump’s Potential Actions on the IRS and Tariffs

This document summarizes key themes and information from the provided excerpt of “Can Donald Trump End The IRS Without Passing One Law? Yes. Yes, He Can.” The source presents a legal argument for how Donald Trump could potentially circumvent Congress to drastically alter US tax policy using existing executive powers.

Main Themes:

- Ending the IRS through Regulatory Action: The core argument revolves around the vagueness of the US tax code, particularly its lack of a clear definition of “individual.” The author posits that this vagueness allows the Secretary of Treasury, appointed by the President, to redefine “individual” via regulation, effectively excluding everyone from the income tax.

- Using the Constitution to Challenge the IRS: The author suggests leveraging the Fourth Amendment’s protection against unreasonable searches and seizures to challenge the IRS’s broad authority to investigate unreported income. By framing the IRS’s actions as unconstitutional, the Secretary of Treasury could justify narrowing the definition of “individual” to those who consent to taxation.

- Unilateral Tariff Implementation: The source asserts that existing laws grant the President broad authority to set tariff rates without Congressional approval, citing the Tariff Act of 1930 and the Trade Expansion Act of 1962. This authority stems from the President’s constitutional role in managing foreign affairs.

Key Ideas & Facts:

- Vague Tax Code: The author highlights the lack of a definition for “individual” in the US tax code, arguing that this loophole allows for significant regulatory manipulation: “The US income tax code never bothers to define what an individual is…”

- Regulatory Power of the Treasury: The author emphasizes the Secretary of Treasury’s power to create and revise regulations governing the tax code, suggesting this power could be used to effectively end the individual income tax.

- Constitutional Challenge: The Fourth Amendment’s protection against unreasonable searches and seizures is presented as a potential legal basis for restricting the IRS’s authority.

- Presidential Authority on Tariffs: The author cites historical precedent and legal statutes to support the claim that the President can unilaterally set tariff rates without Congressional approval.

Key Quotes:

- “Donald Trump can simply appoint a new Secretary of Treasury to draft new regulations…”

- “…the only way to make the US Constitution comply with the law is to define individual as a living person in the US who consents to be taxed.”

- “The Supreme Court has upheld such delegations of authority as constitutional, recognizing that the president has said significant role in foreign affairs and trade negotiations.”

Important Considerations:

- Legal Challenges: The proposed strategies are likely to face significant legal challenges, particularly regarding the interpretation of existing laws and the scope of executive power.

- Political Feasibility: Even if legally possible, these actions would likely be politically contentious and face strong opposition from Congress and various stakeholders.

- Source Bias: The source clearly expresses support for Donald Trump’s policies and presents a one-sided perspective on the legal arguments presented.

Overall, the source provides a thought-provoking, albeit speculative, analysis of how existing legal and regulatory frameworks could potentially be used to enact radical changes to the US tax system. Further research and analysis from legal experts are necessary to assess the validity and feasibility of the proposed strategies.

Add comment