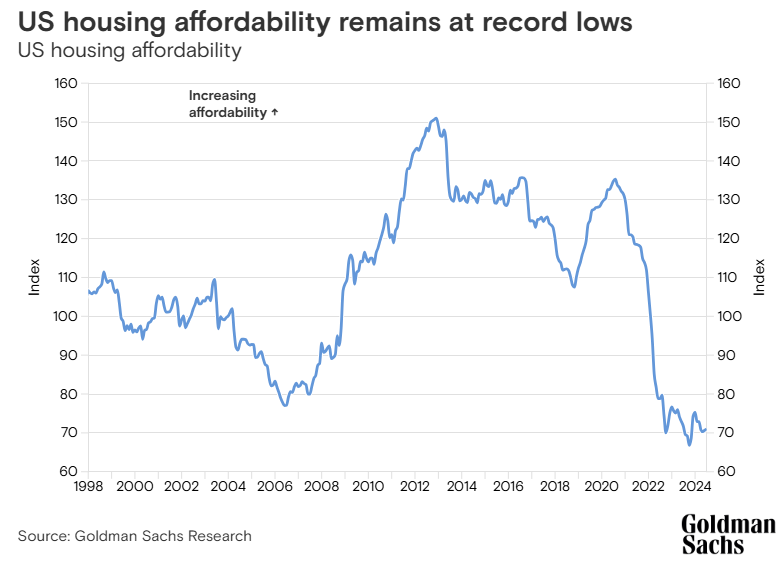

One report predicts persistent housing affordability issues due to high mortgage rates and rising home prices, despite potential Fed rate cuts. A second report, however, anticipates continued home price appreciation, driven by a still-strong economy and gradually decreasing interest rates. This second report suggests improved affordability over the next five years, albeit through a slow process of rate reduction, income growth, and moderate price increases. Regional variations exist, with some areas experiencing stronger growth than others. The reports highlight differing opinions on the speed and nature of housing market recovery.

Listen to a convo on it all…

Goldman Sach’s recent research report disclosed an interesting and disturbing chart. Equity exposure by US households now stands at 48% which mirrors the peak of the tech bubble in the late 1999. As Charlie Munger said, “Mimicking the herd invites regression to the mean.” Tiho Brkin

US Housing Market Outlook: A Tale of Two Forecasts

These two sources, one from ZeroHedge citing a Goldman Sachs report and the other directly from Goldman Sachs Research, present contrasting, yet intertwined outlooks for the US housing market. While both acknowledge the current affordability crisis, they diverge on the future trajectory of home prices and the potential for relief.

Everyone in America needs to be aware of this: – Progress Residential, Aldolfo Villagomez Purchased 90,000 single family homes – Invitation Homes, Dallas Tanner Purchased 83,000 single family homes – American Homes 4 Rent, David P. Purchased 59,332 Single Family Homes – Tricon Residential, Gary Berman Purchased 38,000 single family homes – BlackRock is on track to own 60% of all homes in America by 2030 The cost of homes has skyrocketed in America Private equity firms are buying up all of the homes in America, driving up prices and then renting them back out to you Wall Street Apes

ZeroHedge paints a grim picture:

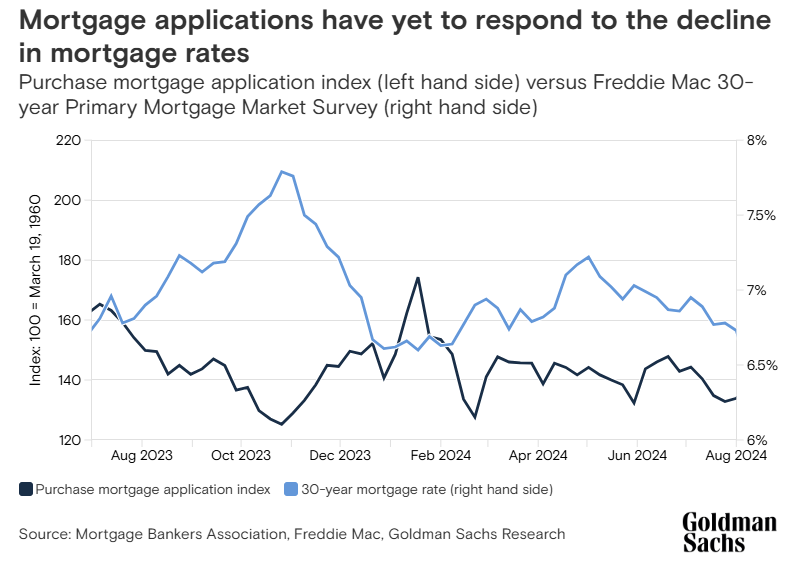

- Mortgage rates are expected to remain stubbornly high in the low-to-mid 6% range through 2025, despite anticipated Fed rate cuts. This directly contradicts the market expectation of steeper rate cuts, squashing the “dovish party” hoping for significant relief.

- Consequently, existing home sales are projected to remain significantly below pre-pandemic levels, further squeezing inventory and fueling price increases.

- Home prices are forecasted to rise by 3% year-on-year, driven by limited supply and sustained demand.

- The affordability crisis is expected to persist, with mortgage payments representing a significant portion of median household income. “The affordability headwinds will be most pronounced on resales, with existing home transactions holding at 4.1mn in 2025 vs the 2015-19 average of 5.4mn. This reflects the lock-in effect, which we believe will remain a headwind for the next several years,” say Goldman analysts.

Goldman Sachs Research, however, offers a more optimistic outlook:

- They have revised their home price appreciation forecast upward to 4.5% for 2023 and 4.4% for 2025, driven by anticipated Fed rate cuts and a resilient economy.

- Analyst Vinay Viswanathan argues that while loosening labor markets might seem like bad news, they actually pave the way for Fed rate cuts, making mortgages more affordable.

- They acknowledge the record low affordability but highlight the resilience of home prices, fueled by strong household formation and limited supply.

- Viswanathan suggests a gradual return to affordability over the next five years, driven by:

- Slowly declining interest rates.

- Continued income growth.

- Moderating home price growth.

Redfin sees home prices up 4% in 2025 “because we don’t expect there to be enough new inventory to meet demand.” pic.twitter.com/YKInnoJtW8

— Neil Sethi (@neilksethi) December 12, 2024

Key points of convergence and divergence:

- Both sources agree that affordability is a major concern. However, they differ on the pace and extent of potential improvement.

- The impact of Fed rate cuts is interpreted differently. ZeroHedge suggests limited impact on mortgage rates, while Goldman Sachs sees it as a key driver of affordability improvement.

- The strength of the housing market is acknowledged by both, but ZeroHedge focuses on the negative consequences for buyers, while Goldman Sachs highlights the underlying economic factors supporting the market.

- Regional variations are emphasized by Goldman Sachs, with the Midwest, Northeast, and California expected to outperform the Southeast, particularly Florida.

Overall, these two sources present a nuanced picture of the US housing market. While both acknowledge challenges, their contrasting interpretations of key factors like interest rates and affordability create diverging narratives about the future. It’s crucial to consider both perspectives when evaluating the market and making informed decisions.

Add comment