Elon Musk: There are too many shady loopholes in the tax code. “A reform of the tax code would make sense because it’s extremely complicated, and there are too many loopholes. I’m often pitched on these loopholes. That’s how I know they exist. I’m like, that sounds pretty shady. I don’t think we should do that. They’re like, well, lots of other people are getting away with it. Yeah, but I still don’t think we should do it.”

Elon Musk: There are too many shady loopholes in the tax code.

“A reform of the tax code would make sense because it’s extremely complicated, and there are too many loopholes.

I’m often pitched on these loopholes. That’s how I know they exist. I’m like, that sounds pretty… pic.twitter.com/P2KynbR71M

— ELON CLIPS (@ElonClipsX) November 16, 2024

“We want a tax code that we can actually read, as humans.” – Elon Musk

“We want a tax code that we can actually read, as humans.” – Elon Musk pic.twitter.com/txhZLIVDVS

— The Heart Speaks (@SGabardi1111) November 24, 2024

Elon Musk: Simplifying the tax code will increase productivity, instead of incentivizing bizarre tax-avoidance behavior – Tweet

Elon Musk on Nove 16th: Good morning 𝕏! President Trump and I are having coffee here at Mar-a-lago on a beautiful Saturday morning. We’re going through plans to delete the IRS and majorly simplify the tax code. We think you should just be able to log into a website, it tells you exactly how much you owe, and you pay it right there. And of course, we think the number you pay should be way lower. Thoughts? Have a great day out there! Tweet

Elon Musk Proposes IRS Audit by ‘DOGE’

– A Call for Government Efficiency?

Justice is coming.. pic.twitter.com/g9MP7eUP7p— ✞▶𝕳𝖎𝖈k-𝖓-𝕿w𝖎𝖘𝖙𝖊𝖉◀✯ (@SickNTwisted9) November 27, 2024

Top 5 arguments commonly made in favor of a no personal income tax policy to replace the current system in the United States:

1. Economic Growth and Job Creation

- Increased Incentives: Without personal income tax, individuals retain more of their earnings, increasing incentives to work, save, and invest.

- Business Expansion: By eliminating income taxes, businesses may see higher consumer spending and reduced tax compliance burdens, fostering job creation and economic expansion.

- Historical Examples: States like Texas and Florida that do not levy state income taxes have experienced strong economic growth and population influxes.

2. Simpler Tax System

- Reduced Complexity: Eliminating personal income tax eliminates the need for complex tax codes, deductions, and credits.

- Lower Compliance Costs: Taxpayers and businesses save billions currently spent on tax preparation and compliance.

- Improved Transparency: A tax system based on consumption (e.g., national sales tax) is more straightforward and easier to understand.

3. Encourages Savings and Investments

- Wealth Accumulation: Without income taxes, individuals can save and invest more, building wealth over time.

- Capital Formation: Increased savings can lead to greater capital investment, benefiting businesses and the overall economy.

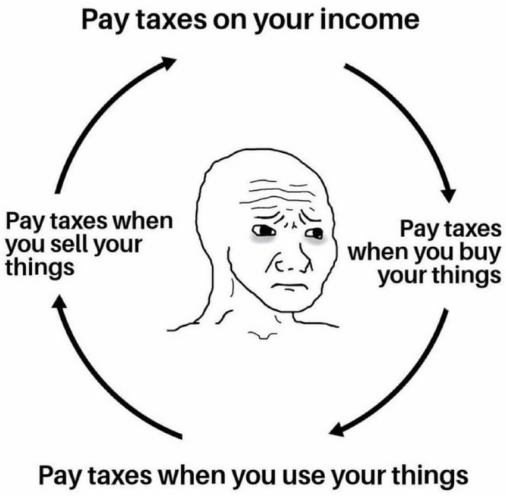

- No Tax Penalty on Productivity: Income tax penalizes productivity, whereas a consumption-based system only taxes spending.

4. Aligns with Fairness and Individual Freedom

- Choice-Based Taxation: A consumption tax allows individuals to choose how much tax they pay based on their spending, aligning with personal freedom.

- Reduces Government Power: Eliminating personal income tax reduces the federal government’s control over individuals’ finances and minimizes bureaucratic oversight.

- Ends Taxation on Earnings: Advocates argue taxing income punishes hard work and success, making a case for taxing spending instead.

5. Boosts International Competitiveness

- Attracts Foreign Investment: A tax-free income system could make the U.S. a magnet for international talent and capital.

- Global Trade Advantage: Without income taxes, businesses face lower operating costs, improving their ability to compete globally.

- Precedent in Other Countries: Countries like Monaco and UAE attract high-net-worth individuals and businesses due to no personal income tax policies.

OMG IT’S HAPPENING Ron Paul was asked by Elon Musk to advise the newly formed Department of Government Efficiency (DOGE) He has been calling to obliterate the IRS, CIA, FBI, and the Federal Reserve decades ago.

OMG IT’S HAPPENING‼️

Ron Paul was asked by Elon Musk to advise the newly formed Department of Government Efficiency (DOGE) 😱

He has been calling to obliterate the IRS, CIA, FBI, and the Federal Reserve decades ago.https://t.co/qHcMaHNL3X pic.twitter.com/BpO6zcjQV4

— MJTruthUltra (@MJTruthUltra) November 22, 2024

WESTERN TAX CODES RANKED: HOW DOES SWEDEN DO IT IN 100 PAGES?!

The UK tax code is so long (17,000+ pages), you’d need a lifetime and a ship of tea to read it. The US tax code is a whopping 6,800 pages—longer than Marcel Proust’s “In Search of Lost Time,” the longest book ever written, at 4,200 pages. @elonmusk: “Crazy idea: let’s simplify the tax code” Well, Sweden has done it with just 100 pages. Here’s the ranking:

United Kingdom: 17,000+ pages (Seriously, why?!) United States: 6,800 pages (Don’t worry, we’ve got TurboTax!) Australia: 5,000 pages (That’s a lot of “mates.”) Canada: 3,000 pages (Blame the moose?) Germany: 1,700 pages (Efficient… but still hefty.) France: 1,500 pages (Wine probably helps.) Spain: 1,000 pages (Olé for less confusion!) Italy: 800 pages (Mostly pasta deductions?) Netherlands: 400 pages (And bikes?) Sweden: 100 pages (HOW?!) Is it time for everyone else to ditch the madness and go full Sweden? Sources: CBS News, Investopedia, Britannica

A Federal Sales Tax to REPLACE personal income taxes along with Tariffs: BAM – A federal sales tax is simpler—no complicated forms, no loopholes for the rich, and no IRS breathing down your neck. You’d only pay taxes when you spend money, so saving and investing wouldn’t be penalized. Plus, billionaires buying yachts or tourists visiting the U.S. would contribute, too. But there’s a downside. Sales taxes can hit lower-income families harder because they spend a bigger chunk of their income on basics. That’s why some systems exempt necessities like food and medicine to even the playing field. Mario Nawfal Tweet

Elon Musk has broken the record for being the largest individual taxpayer ever, contributing over $10 billion in taxes. Elon jokingly suggested the IRS could’ve sent him a trophy, an award, or even a cookie to say thanks for the massive contribution!

Elon Musk has broken the record for being the largest individual taxpayer ever, contributing over $10 billion in taxes.

Elon jokingly suggested the IRS could’ve sent him a trophy, an award, or even a cookie to say thanks for the massive contribution! 😂 pic.twitter.com/g90J7Apu6B

— SMX 🇺🇸 (@iam_smx) November 24, 2024

The IRS wants $20 billion more dollars when Trump gets in office. Elon Musk plans to audit the IRS with DOGE. How about we abolish the IRS? That would boost our economy and give Americans breathing room again.

- IVERMECTIN – – – – -Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs, guide book, much more… peace of mind for you and your family) 🛑 – Dr. McCullough’s company! – Sponsor

- New Junkie Paradise – Whatfinger News – More news daily than any other news site on Earth – CLICK HERE

- Dr. Zelenko is the man who advised Trump on Hydroxy ..Here’s his recipe to keep immunity strong – Zelenko Z Stack

Book Discussions And Guides – You can listen in to a convo on some Choice Books, with study guide. You can tell that teaching is about to take a new turn in the world…No more Leftist teachers soon. This makes learning about books so much easier before you tackle them – listen while surfing other links

- Animal Farm: Discussion and A Study Guide – Audio

- The Secret: Law of Attraction – Discussion and Study Guide – Audio

- The 48 Laws of Power: Discussion and A Study Guide – Audio

- Sun Tzu’s Art of War: Discussion and Study Guide – Audio

- The Law Of Success: Napoleon Hill – A Discussion and study – Audio

- Nineteen Eighty-Four: A Conversation On 1984 – Audio

- The Great Gatsby: A Discussion and Study Guide – Audio

Add comment