Bitcoin is up 371% since Jim Cramer said to sell everything.

Inverse Cramer never fails. pic.twitter.com/HVLTk5UgIW

— Chairman (@WSBChairman) November 11, 2024

BREAKING: Bitcoin has just reached a NEW all-time high of $89,000, rising by 11% in the last 24 hours. We’re entering a short period of time where getting rich will be on EASY mode. Have you been preparing in the trenches? – The Real World Tweet

Andrew Tate predicted in 2022, with Bitcoin at $18,000, that it would skyrocket in two years 🤯 pic.twitter.com/Bd6rAEcMnb

— Tate Updates (@tateupdatesx) November 11, 2024

24/7 Crypto News from all sources – Whatfinger Crypto

- Bitcoin’s Record Surge: Bitcoin’s value soared to a new all-time high of $75,060, marking a 7% increase.

- Market Reaction to Election: The surge is attributed to investors anticipating a victory for Donald Trump in the U.S. presidential election.

- Cryptocurrency Regulation Expectations: A potential Trump administration is expected to adopt a more lenient stance on cryptocurrency regulations.

- Election Results: Trump secured 15 states, while Democratic candidate Kamala Harris won seven states and Washington, D.C., according to Edison Research projections.

- Financial Markets’ Response: Early financial market movements in Asia began pricing in a possible Trump victory.

- Analyst Insights: Matthew Dibb, Chief Investment Officer at Astronaut Capital, noted that markets anticipate a shift in the U.S. Securities and Exchange Commission’s approach, potentially easing restrictions on crypto innovation and speculation.

- Alternative Cryptocurrencies: Ether, another major cryptocurrency, experienced a 7.5% increase, reaching $2,593, though it remains below its 2021 peak.

- Investor Sentiment: The rise in Bitcoin’s value reflects growing investor confidence in the cryptocurrency market amid political developments.

- Historical Context: Bitcoin’s previous record high was in March 2024, indicating significant growth within the year.

- Global Market Impact: The cryptocurrency surge highlights the interconnectedness of global financial markets and political events.

- Regulatory Environment: Expectations of a softer regulatory approach under a Trump administration are influencing market dynamics.

- Market Volatility: The cryptocurrency market remains highly volatile, with values susceptible to rapid changes based on political and economic news.

- Investor Strategies: Traders are closely monitoring election outcomes to inform their investment decisions in the cryptocurrency space.

- Future Projections: Analysts suggest that continued political developments will play a crucial role in shaping the cryptocurrency market’s trajectory.

- Broader Economic Implications: The surge in Bitcoin’s value may have wider implications for digital currencies and their acceptance in mainstream financial systems.

The US owns 0.06% of GDP in Bitcoin — about $18 billion. El Salvador owns 1.5% of GDP in Bitcoin — in US terms, about $500 billion. Bhutan owns 34% of GDP in Bitcoin — in US terms, about $10 trillion. – Peter St Onge Tweet

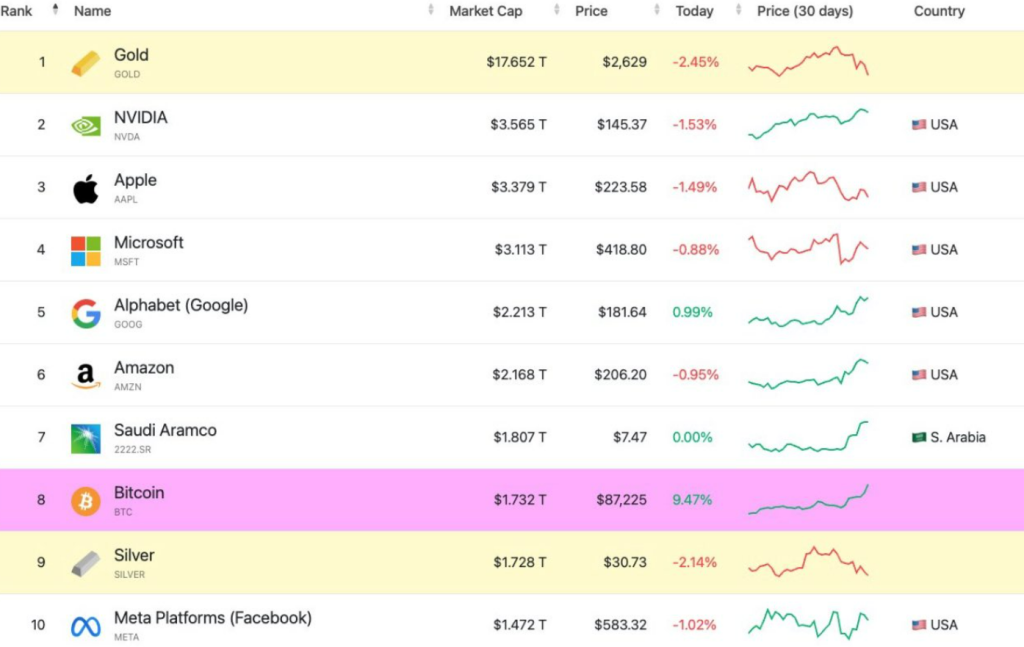

BITCOIN FLIPS SILVER AND BECOMES THE 8TH LARGEST ASSET BY MARKET CAP IN THE WHOLE UNIVERSE

Add comment